The Best Time to Start Saving Was Yesterday

Remember when you were a carefree college student who thought 30 was old? (Ha!) Or when you got your first “real” job and didn’t know what a 401(k) was?

Back then, you probably thought retirement was SO far away. And it was… but there’s a reason your parents always nagged you to stop spending so much on booze and start saving instead. And why your manger asked if you were SURE you wanted to contribute only the minimum every month.

It makes sense why young people tend to procrastinate saving. When you’re in your 20s, salaries are lower, debts are higher and budgets are tighter. It’s hard to see the benefit of setting aside a portion of your minimal funds in an account you won’t even use for another 30 to 40 years. It’s tough to think about the end of your career at the beginning of it.

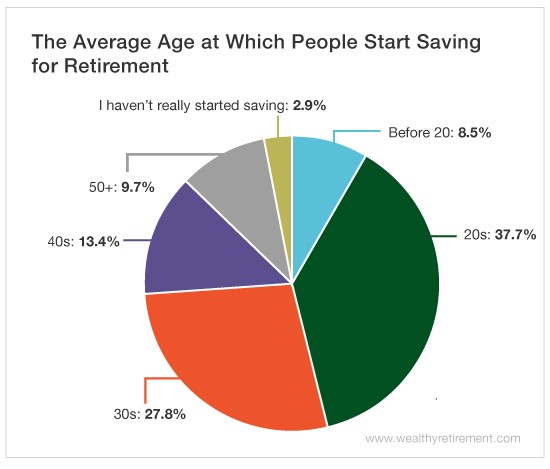

According to our research, a little more than a third of our readers – 37.7% to be exact – started saving for retirement in their 20s. That’s better than the national average – but it’s still not as high as we’d like.

See, the earlier you start saving, the more you can take advantage of the power of compounding. That’s when the interest on your account builds exponentially over time, meaning your money is essentially making you even more money… without any effort on your end.

It adds up fast too. Putting off saving until you’re 35 could be the difference between retiring at 65 with $750,000 versus the $1.15 million you would have saved had you started at 25.

If you’re one of the 65% of people who started banking bucks for your golden years in your 20s or 30s, give yourself a pat on the back. You’re doing better than the average American.

And if you’re one of the late bloomers, there’s still time to catch up. Even for those of you already in retirement, there are easy ways you can bolster your funds without living like a pauper. You can find some of those unique strategies in Marc Lichtenfeld’s new book by clicking here.

Remember it’s never too early – or too late – to start saving for retirement.

Good investing,

Amanda