The Hottest Sectors… and Why You Shouldn’t Care About Them

At a recent conference, the subject of what’s “hot” in the industry was brought up.

“Crypto,” said one expert.

“Pot stocks,” claimed another.

“Penny stocks,” declared a third.

“Everyone wants trading systems,” stated an authority.

Another guru advised, “Income always sells.”

So with that, I’m happy to introduce you to Marc Lichtenfeld’s Crypto Penny Pot Stock Income System Trader.

I’m joking, of course. Though I bet it would sell.

A much less sexy area of the market that is harder to sell but where investors routinely make great money is the healthcare space.

For speculative investors, there are small stocks – especially in the biotech sector – that have the potential of doubling overnight and going up hundreds of percentage points in a few months or years.

For more conservative investors, there are a number of high-quality companies that not only will provide great growth opportunities but will generate a meaningful amount of income as well.

For example, one of my favorite healthcare stocks is the big pharmaceutical maker AbbVie (NYSE: ABBV).

On March 6, 2017, when I recommended it, the price was $63.22. At the same time, for investors who really wanted to go for big gains, I suggested the AbbVie January $75 calls at $1.18.

We exited the stock on February 1, 2018, at a price of $112.44, for a total return (including dividends) of 81%.

The options play was even bigger. When we sold that position on January 19, 2018, the calls were trading at $29.28, another huge gain.

But I also recommended the stock for long-term investors.

That’s because when I suggested buying the stock at about $57, it was yielding 3.8%. Importantly, the company has raised its dividend seven times since it began paying one in 2013. Because of the dividend raises, AbbVie now yields a very strong 6.7% on our original price and 3.9% on its current price.

AbbVie has an impressive set of products, including cancer blockbuster Imbruvica, which many people expect to eventually generate up to $7 billion a year in revenue.

Additionally, it has a pipeline of 30 drugs that should create plenty of cash flow and fund not only growth but dividend increases as well.

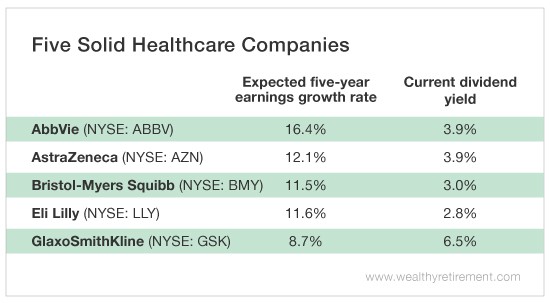

There are many high-quality healthcare companies that reward shareholders with both dividend income and growth potential.

The table below shows the expected earnings growth rates and current dividend yields of five great healthcare companies.

Getting in on a hot new trend can certainly make you money if you’re early enough. But rather than trying to time new trends and hoping to get it right, I prefer sticking with what has worked for decades.

Healthcare stocks have a long history of providing growth and, in many cases, income. There will always be demand for healthcare products and services.

I’m not sure I can say the same for the Crypto Penny Pot Stock Income System Trader.

Good investing,

Marc